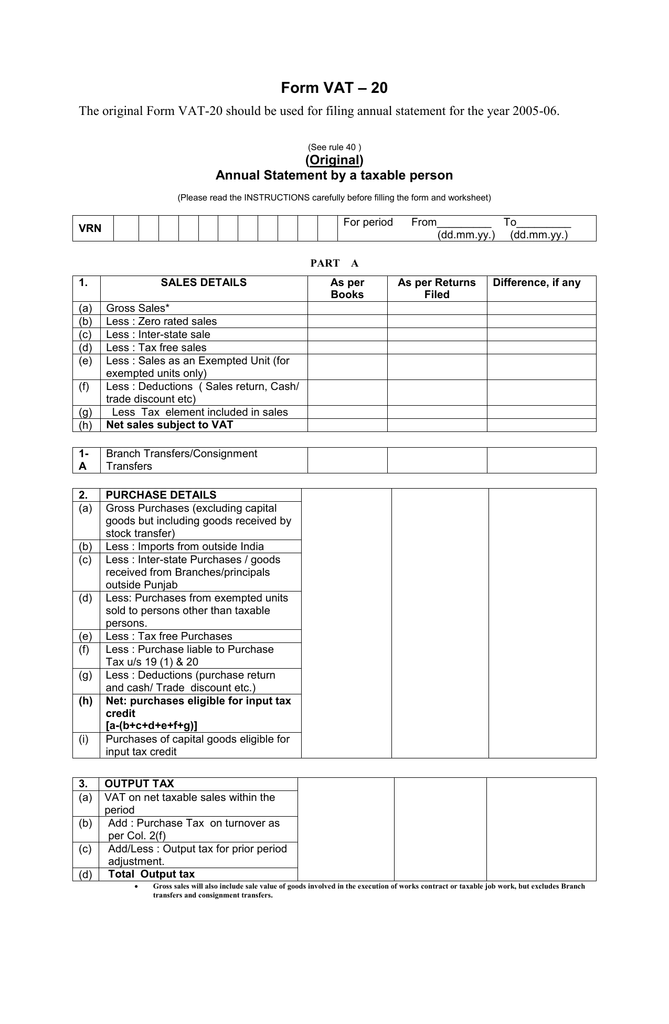

Vat Form | An aspect of fiscal policy. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. The vat1 form will remind you to complete one of these forms. These unofficial translations of the vat forms are for your information only. If you do not have a uk national insurance number, you will be required to provide your tax identification number together with the.

Vat registration no:* please enter a value please enter a numeric value. Click here to below all vat forms are available with single click download facility. Find vat forms and associated guides, notes, helpsheets and supplementary pages. As of 2016, 166 of the world's. Vat eservices · vat faq · vat strategic statement · vat compliance guides · vat act · vat rules · vat forms · vat sros · vat gos · vat appeal.

Insolvent traders claim for input tax after deregistration (vat426). Please print and sign this declaration form and upload in the 'vat online form 1' online application form. Find all up vat forms at one place, latest uttar pradesh vat forms. About the french value added tax (vat) return form. These unofficial translations of the vat forms are for your information only. 1617006 dated 5th may 2016). The vat1 form will remind you to complete one of these forms. Learn about uk vat returns. List of organizations using efd and sdc. What vat can be deducted? If you do not have a uk national insurance number, you will be required to provide your tax identification number together with the. Print and post application take up to 30 days. 14 days after tax period.

How often vat returns are required? About the french value added tax (vat) return form. The vat import declaration form is also designed to be straightforward and wherever possible it will 2. Find vat forms and associated guides, notes, helpsheets and supplementary pages. Please print and sign this declaration form and upload in the 'vat online form 1' online application form.

Print and post application take up to 30 days. An aspect of fiscal policy. Find vat forms and associated guides, notes, helpsheets and supplementary pages. What vat can be deducted? It is a tax on consumption levied on the sale, barter, exchange or lease of goods or properties and services in the philippines and on importation of goods. How often vat returns are required? Vat eservices · vat faq · vat strategic statement · vat compliance guides · vat act · vat rules · vat forms · vat sros · vat gos · vat appeal. 14 days after tax period. Online applications take around 20 days. Vat registration no:* please enter a value please enter a numeric value. 0%0% found this document useful, mark this document as useful. Please print and sign this declaration form and upload in the 'vat online form 1' online application form. Find all up vat forms at one place, latest uttar pradesh vat forms.

Option to tax land and buildings. Vat returns must be completed monthly on a special form and filed with the local tax office between the 15th and 24th day of the following month. Please print and sign this declaration form and upload in the 'vat online form 1' online application form. List of organizations using efd and sdc. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer.

If you do not have a uk national insurance number, you will be required to provide your tax identification number together with the. An aspect of fiscal policy. Vat returns must be completed monthly on a special form and filed with the local tax office between the 15th and 24th day of the following month. Vat registration no:* please enter a value please enter a numeric value. The vat import declaration form is also designed to be straightforward and wherever possible it will 2. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. Insolvent traders claim for input tax after deregistration (vat426). Option to tax land and buildings. So now scroll down below and download all. Find all up vat forms at one place, latest uttar pradesh vat forms. As of 2016, 166 of the world's. Savesave vat forms for later. Learn about uk vat returns.

Vat Form: So now scroll down below and download all.

0 komentar:

Posting Komentar